Introductory Overview to Value Delivery in the Rise-and-Decline of General Electric

Introductory Overview to Value Delivery in the Rise-and-Decline of General Electric

Four-Part Series on our Value-Delivery blog

By Michael J. Lanning––Copyright © 2021 All Rights Reserved

We contend that now, more than ever, business leaders need strategies that profitably deliver superior value to customers. The power of applying––and downside of neglecting––these principles of value delivery are extremely well illustrated by studying the growth and decline of General Electric.

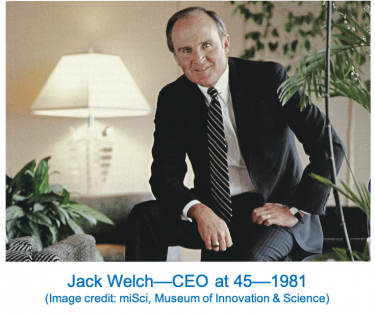

Jack Welch, GE’s legendary CEO––1981-2001––famously urged businesses to, “Control your own destiny.” By 2001, GE had become the world’s most valued and admired company, apparently fulfilling Welch’s vision of destiny-controlled. However, in retrospect, the company’s greater and more lasting achievements came in the prior, partially forgotten first century––1878-1980. Using principles of value-delivery strategy, GE built a corporate giant on a base of great product-innovation.

Then, however, despite its much celebrated, apparent great triumph, the Welch strategy and its continuation under successor Jeff Immelt largely abandoned those strategic principles. Instead, the company chased self-deceiving illusions, ultimately losing control of its destiny, and declining precipitously––though stable now. The four-part Value-Delivery-Blog series introduced here aims to identify the still-relevant key principles of GE’s historic strategy that, in its first century, made it so important––but which, by their later neglect and decay, eventually led to its major decline and missed-opportunities.

At the end of this Introductory Overview, the reader can use a link that is provided to Part One.

Note from the author: special thanks to colleagues Helmut Meixner and Jim Tyrone for tremendously valuable help on this series.

Part One: Customer-Focused, Science-Based, and Synergistic Product-Innovation (1878-1980)

GE built a corporate giant in its first century via major product-innovations that profitably delivered real value to the world. These innovations followed three principles of value-delivery strategy, discussed in Part One––they were customer-focused, science-based, and where possible, powerfully synergistic among GE businesses.

Following the first, most fundamental of these three principles, GE innovations in that first century were customer-focused––integrated around profitably delivering superior value[1] to customers. Thus, GE businesses delivered winning value propositions––superior combinations of customer-experiences, including costs. We term a business managed in this way a “value-delivery-system,” apt description for most GE businesses of that era.

Following the first, most fundamental of these three principles, GE innovations in that first century were customer-focused––integrated around profitably delivering superior value[1] to customers. Thus, GE businesses delivered winning value propositions––superior combinations of customer-experiences, including costs. We term a business managed in this way a “value-delivery-system,” apt description for most GE businesses of that era.

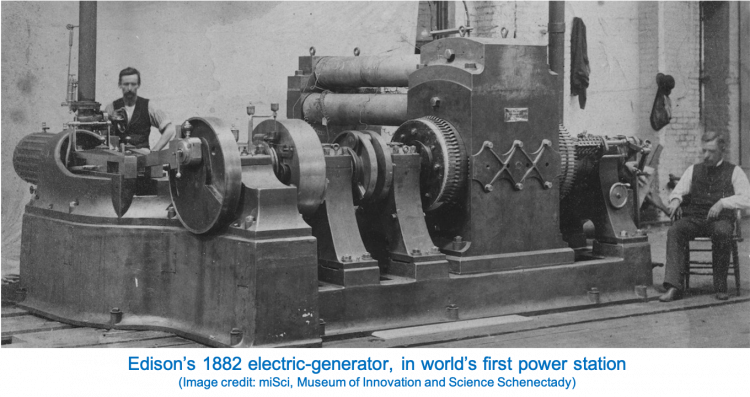

Part One discusses two key examples of these GE value-delivery-systems successfully created and expanded in that century after 1878. First is the company’s electric lighting-and-power value-delivery-system. It included incandescent-lamps––light bulbs––and the supply of electricity to operate the lighting. Edison and team studied indoor-lighting users’ experiences––with gas-lighting––and designed ways to improve those experiences.

Thus, users were offered a superior value proposition––proposing that they replace their gas-lighting system with Edison’s electric one. As discussed in Part One, users in return got a superior set of experiences, including greater safety, more comfortable breathing––the air no-longer “fouled” by gas––with higher-quality light, shorter-but-adequate lamp-life, and equally convenient operation, all at lower total cost than gas lighting. Profitably delivering this value proposition was enabled by key elements of lamp-design, more efficient electricity generation-and-distribution, and other important inventions.

This brilliant, integrated system was GE’s founding and most important innovation. Aside from the lamps, consider just electric-power. Discussing the world’s infrequent, truly-breakthrough advances in technology, historian of science Vaclav Smil writes

And there has been no more fundamental, epoch-making modern innovation than the large-scale commercial generation, transmission, distribution, and conversion of electricity.… the electric system remains Edison’s grandest achievement: an affordable and reliably available supply of electricity has opened doors to everything electrical, to all great second-order innovations ranging from gradually more efficient lighting to fast trains, from medical diagnostic devices to refrigerators, from massive electrochemical industries to tiny computers governed by microchips.

Then, in the first fifteen years of the twentieth century, the company expanded this electric lighting-and-power value-delivery-system. Its new power-innovations made electricity more widely available by helping enable long-distance transmission. Its new lighting innovations produced major advances in lamp efficiency.

A second key GE value-delivery-system discussed in Part One is medical-imaging. Starting with advances to the X-ray tube, GE much later develops the first practical magnetic-resonance-imaging (MRI) machine. These innovations delivered a superior value proposition––first making diagnoses more accurate and reliable, and later, via MRI, safer.

In the great product-innovations of its first century, GE’s first strategic principle was to be customer-focused. As a result, it repeatedly created winning value-delivery-systems––integrating activity around profitable delivery of superior value propositions.

Its second strategic principle was taking a science-based approach to its product-innovation efforts. In that era, GE’s major product-innovations were typically led by highly-knowledgeable physicists, chemists, or other scientists, making extensive use of mathematics and data. The company led all industry in establishing a formal laboratory devoted to scientific research in the context of developing practical, valuable products. This science-based approach increased the likelihood that GE’s product-innovations would result in truly different, meaningfully superior customer experiences. It also helped make delivery of these experiences profitable and proprietary (e.g., patent-protected) for the company.

Rigorous application of scientific theory and data enabled many GE innovations. Edison’s lighting-and-power project developed its key insight––concerning electrical-resistance––by using the early science of electronics. Other examples of the importance of GE’s science-based approach included the work enabling alternating current (AC), improvements to the X-ray tube, use of tungsten-knowledge to improve lamps, and later the extensive physics and engineering work to make MRI a practical reality. Notably, it also transformed GE Plastics–––from providing secondary support for the electrical businesses, to a major business––which we also discuss in Part One.

GE also applied a third key principle––where possible, it identified or built, then reinforced, powerful synergies among its businesses. Based on reapplication of technologies and customer-insights from one GE business to another, these were shared strengths, enabling new GE innovations, further profitably delivering superior value.

In its first century, GE had great success developing synergies related to its electrical and electromagnetic roots. All its major businesses––except plastics––shared these electrical roots. They thus synergistically shared valuable knowledge and insights that were customer-related and science-based. The company’s founding innovation––the Edison lighting-and-power value-delivery-system––was inherently synergistic. Power enabled lighting; lighting justified and promoted power. GE later emulated this synergy by developing its household-appliance business. As discussed in Part One, perhaps the company’s greatest example of synergies between seemingly unrelated businesses was the sharing of turbine technology, first developed for power, then reapplied to aviation.

GE would also fail to realize some synergistic opportunities tied to its electrical roots. Most surprisingly, the company gave up easily on the crucially important markets for semi-conductors and computers, while embracing plastics, its first major non-electrical business. This subtle drifting away from its electrical roots foreshadowed GE’s later, ultimately problematic focus on non-electrical businesses––especially the financial kind. Still, GE’s first century was a tour de force of value-delivery-driven product innovation. After 1981, Welch and team should have better understood and reinvigorated those past strengths.

Part Two: Unsustainable Triumph of the Welch strategy (1981-2010)

For over 20 years after 1981, GE triumphed with Jack Welch’s radical new strategy that included a significant reliance on financial services, a strategy continued by Welch successor Jeff Immelt until about 2010. As discussed in Part Two, this complex strategy ingeniously melded some strengths of GE’s huge and reliably profitable traditional businesses with its aggressive, new financial ones. It enabled the latter to benefit uniquely from GE’s low corporate cost-of-borrowing––due to its huge,  profitable, and exceptionally credit-worthy traditional businesses.

profitable, and exceptionally credit-worthy traditional businesses.

This hybrid strategy was largely not available to financial competitors as they lacked GE’s huge traditional product businesses. Thus, with this crucial cost advantage, the new GE financial businesses could profitably deliver a clearly superior value proposition to financial customers. Therefore, these financial businesses grew dramatically and profitably in the Welch era, leading GE’s overall exceptional profitable growth, making GE the world’s most valued and admired corporation by 2001. Yet, there were longer-term flaws hidden in this triumphant strategy.

* * *

Through our value-delivery lens we see many businesses’ strategies as what we term “internally-driven.” Managers of an internally-driven business think inside-out, deciding what products and services to offer based on what they believe their business does best, or best leverages its assets and “competencies.” They are driven by their own internal agenda, more than what customers would potentially value most. Even though GE’s financial businesses delivered a profitable, superior value proposition for two decades, the overall Welch strategy increasingly became internally-driven.

Instead of insisting on new product-innovation in the traditional industrial businesses, the old core businesses were used more to help enable the rapid, highly profitable growth of the financial business. Moreover, the hybrid strategy’s advantages and resulting growth were inherently unsustainable much past 2000. Its heady successes likely led Welch’s and later Immelt’s teams to embrace the illusion that GE and they could master financial or any other business, no matter how new and complex. However, the high returns in GE Capital (GEC, its finance business) reflected high risk, not just financial innovation, and higher risk than GE fully understood. These risks very nearly wrecked the company in 2008-09.

In addition, as will be discussed in Part Two, the unique cost advantage of the GE financial businesses (GEC) could not drive much-faster growth for GEC than the non-financial businesses indefinitely. Given the accounting and regulatory rules of the time, GEC’s cost advantage was only available if GEC’s revenues remained less than fifty-percent of total GE. That threshold was reached in 2000. After that point, GE either needed to reduce GEC’s growth rate, or dramatically increase the growth rate for the traditional businesses. Welch was likely aware of this problem in 2000 when he tried to make the gigantic acquisition of Honeywell, but the European regulators rejected this move, on antitrust terms. The limitations of the strategy, and pressures on it, were clearly emerging by 2000.

Thus, the Welch and then Immelt teams needed to replace the GEC-centered strategy, creating a new surge of product-innovation in the non-financial businesses, in order to grow the aging company. Complicating this challenge, however, GE’s internally-driven instinct focused increasingly on financial engineering, efficiency, and optimization. Eventually, its historically crucial capabilities of customer-focused, science-based product innovation, with shared synergies, all weakened. GE’s industrial product-innovation capabilities had atrophied. As USC School of Business Gerard Tellis writes:

Ironically, GE rose by exploiting radical innovations: incandescent light bulbs, electric locomotives, portable X-ray machines, electric home appliances, televisions, jet engines, laser technologies, and imaging devices. Sadly, in the last few decades, that innovation-driven growth strategy gave way to cash and efficiency-focused acquisitions.

R&D spending continued, but the historical science-based focus on product-innovation breakthroughs gave way to a focus on cost, quality and information technology (IT). Moreover, a new synergy was achieved between the traditional and financial businesses, but the historic emphasis on synergy in product-innovation declined.

Welch’s high-octane strategy was not only flawed by being an internally-driven approach but was also unsound in that it was what we term “customer-compelled.” Again, through our value-delivery lens, we see many businesses trying to avoid the obvious risk of internally-driven thinking––the risk of neglecting or even ignoring what customers want. Therefore, they often follow a well-meaning but misguided customer-compelled strategic map, just as GE did during and after Welch. They strive to “be close and listen” to customers, promising “total satisfaction,” but they may fail to discover what experiences customers would most value, often because customers do not know what they would most value. That logical error was a limitation in one of Welch’s key, most widely influential initiatives––the Six Sigma model.

This demanding, data-intensive technique can be very powerful in reducing variances in product performance, highly useful in achieving manufactured products (or services) that much more precisely meet customers’ requested performance. However, it is only effective if we understand correctly what the most valuable dimensions of that performance are. Otherwise, we only get a customer-compelled result, not a very valuable result for the customer. Moreover, the Six Sigma approach could also be used in an internally-driven way. A business may select a dimension of performance for which it knows how to reduce variance, but which may not be a dimension of highest value to the customer. The technique will then lead again to less variance, but not more value for the customer.

Welch was sometimes hailed not only for his––ultimately too clever––strategic hybrid of the industrial and financial businesses. He was also lionized, until the recent years of GE’s decline, for his major emphasis on efficiency, reducing cost and increasing marginal quality, including Six Sigma. These initiatives achieved meaningful cost reduction––a part of delivering value to customers. But by the 2010s (after the financial crisis) many business thinkers changed their tone. In 2012, for example, Ron Ashkenas in HBR writes:

Six Sigma, Kaizen, and other variations on continuous improvement can be hazardous to your organization’s health. While it may be heresy to say this, recent evidence from Japan and elsewhere suggests that it’s time to question these methods… Looking beyond Japan, iconic six sigma companies in the United States, such as Motorola and GE, have struggled in recent years to be innovation leaders. 3M, which invested heavily in continuous improvement, had to loosen its sigma methodology in order to increase the flow of innovation… As innovation thinker Vijay Govindarajan says, “The more you hardwire a company on total quality management, [the more] it is going to hurt breakthrough innovation. The mindset that is needed, the capabilities that are needed, the metrics that are needed, the whole culture that is needed for discontinuous innovation, are fundamentally different.”

In 2000 Jeff Immelt took over as GE CEO. During 2000-2007, Immelt’s GE increased R&D and produced incremental improvements in product cost, quality, and performance, and advances in IT. However, GE needed to return, more fundamentally, to its historical strengths of customer-focused, science-based product-innovation. The company needed to fundamentally rethink its markets and its value-delivery-systems––deeply studying the evolution of customer priorities and the potential of technology and other capabilities to meet those priorities.

They might have discovered major new potential value propositions, and implemented new, winning value-delivery-systems, perhaps driven again by product-innovation as in GE’s first century. However, Immelt and team seemed to lack the mindset and skills for strategic exploration and reinvention. They sensed a need to replace the Welch strategy but depended on GEC for profits. They thus proved, not surprisingly, too timid to act until too late, resulting in near-fatal losses in the 2008 financial crisis. This flirting with disaster was followed by a decade of seemingly-safe strategies, lacking value-delivery imagination.

Part Three: Digital Delusions(2011-18)

Thus, we saw that the Welch finance-focused strategy which seemed so triumphant in 2001 turned out to be tragically flawed, longer-term. It had led the company to largely abandon its earlier, historical commitment to value-delivery-based product-innovation in the traditional, non-financial businesses. In addition, the shiny new finance-focused strategy was riskier than the company understood, until it was too late. Finally, the strategy’s apparent triumph must have encouraged the Welch and Immelt teams to believe they could succeed in any business. That belief was nurtured by some successes without electrical roots––especially GE Plastics, and perhaps NBC––and further by the Management Training program in Crotonville. The myth of GE invincibility in any business would be dismantled, first by the financial crisis but then further in the years after 2011.

Once the GEC-centered strategy imploded, Immelt and GE hoped to replace it with a grand, industrial-related strategy that could drive nearly as much growth as the Welch strategy had. However, such a strategy needed to identify and deliver value propositions centrally important to industrial customers’ long-term success, including by product innovation. GE did focus on a technology for marginally optimizing operational efficiency. Though not the hoped-for sweeping growth strategy, this opportunity could have had value, but unfortunately GE converted it into a grandiose, unrealistic vision it could not deliver.

In 2011, the company correctly foresaw the emerging importance, combined with Big Data Analytics, of what it  coined the “industrial internet of things” (IIoT). This technology, GE argued, would revolutionize predictive maintenance––one day eliminating unplanned downtime––saving billions for GE and others. However, no longer a financial powerhouse and now refocusing on its industrial business, GE did not want to be seen as a big-iron dinosaur; it wanted to be cool––it wanted to be a tech company.

coined the “industrial internet of things” (IIoT). This technology, GE argued, would revolutionize predictive maintenance––one day eliminating unplanned downtime––saving billions for GE and others. However, no longer a financial powerhouse and now refocusing on its industrial business, GE did not want to be seen as a big-iron dinosaur; it wanted to be cool––it wanted to be a tech company.

So, focused on the IIoT, GE dubbed itself the world’s “first digital industrial company.” It would build the dominant IIoT software platform, on which GE and others would then develop the analytics-applications needed for its predictive-maintenance vision. Immelt told a 2014 GE managers’ meeting, “If you went to bed last night as an industrial company, you’re going to wake up this morning as a software and analytics company.” This initiative was applauded as visionary and revolutionary. HBS’ Michael Porter noted:

“It is a major change, not only in the products, but also in the way the company operates…. This really is going to be a game-changer for GE.”

However, GE’s game-changer proved to be both overreach and strategically incoherent, ultimately changing little in the world. Going back to the Welch era, GE leaders had long believed they could master any business, using GE managerial principles and technique (e.g., Welch’s vaunted systems of professional management and development, the celebrated Six Sigma, its focus on dominant market position in every market, and others). Even though overconfidence had already previously contributed to GE’s financial-business disaster, perhaps we still shouldn’t be surprised by their 2016 stated “drive to become what Mr. Immelt says will be a ‘top 10 software company’ by 2020.” As leadership tells the MIT Sloan Review in 2016:

GE wants to be “unapologetically awesome” at data and analytics… GE executives believe [GE] can follow in Google’s footsteps and become the entrenched, established platform player for the Industrial Internet — and in less than the 10 years it took Google.

The company implausibly declared its intent to lead and control the IIoT/analytics technology, including its complex software and IT. Such control would include application to all industrial equipment owned by GE, its customers, and its competitors. This vision was quixotic, including its inherent conflicts (e.g., competitors and some customers were uninterested in sharing crucial data, or otherwise enabling GE’s control).

GE’s Big Data initiative did offer a value proposition––eliminating unplanned downtime, which sounds valuable––to be achieved via IIoT/analytics. However, how much value could be delivered, relative to its costs and tradeoffs, and the best way to perform such analytics, will obviously vary dramatically among customers. The initiative seemed more rooted in a vision of how great GE would be at IIoT/analytics than in specific value propositions that would be valued by specific segments. It thus betrayed the same internal focus that had plagued the company earlier.

In contrast, Caterpillar––as discussed in Part Three––used IIoT/analytics technology strategically, to better deliver its clear, core value proposition. Developed by deeply studying and living with its customers, Cat’s value proposition focuses on lower total-life equipment cost, for construction and mining customers, provided via superior uptime. Cat also understood, realistically, that it was not trying to become the Google of the industrial internet, but rather would depend heavily on a partner with deep expertise in analytics, not imagining they could do it all themselves. GE’s IIoT initiative was very enthusiastic about the power of data analytics, but it seems plausible that GE never grasped or acted on the importance of in-depth customer-understanding that Cat demonstrated with success.

In addition, the GE strategy did not seem intended to help develop major new product-innovations, as part of delivering winning value propositions. IIoT/analytics technology could possibly enhance continuous improvement in efficiency, cost, and quality, but not help return the company’s focus, as needed, to breakthrough product-innovation. Innovation-consultant Greg Satell noted that GE saved billions in cost by “relentlessly focusing on continuous improvement.” At the same time, he attributes a scarcity in significant inventions at GE since the 1970s to a “lack of exploration.” He writes, “Its storied labs continuously improve its present lines of business, but do not venture out into the unknown, so, not surprisingly, never find anything new.”

Value can be delivered using IIoT/analytics. GE hired hundreds of smart data scientists and other capable people; no doubt GE delivered value for a few customers and could have done more if they had continued investing. Yet, it spent some $4 billion, made some illusory claims to supplying––and controlling––everything in the industrial internet, and ultimately achieved minimal productive result. GE found it could not compete with the major cloud suppliers (e.g., Amazon and Microsoft). More important, effective analytics on the IIoT required vastly greater customization, to specific sectors and individual customers, than GE had assumed––not a single, one-size-fits-all platform. Before giving up in 2018, GE had only convinced 8% of its industrial customers to use its Predix platform.

Part Four: Energy Misfire (2001-2019)

So, after 2001 GE first tried to ride the GEC tiger and was nearly eaten alive in the process. Then it chased the illusion of IIoT dominance, with not much to show for it. Meanwhile, GE was still not addressing its most pressing challenge––its need for new, synergistic strategy for its industrial businesses, to replace the growth engine previously supplied by the finance businesses. Especially important were its core but inadequately understood energy-related markets. In these, GE harbored costly, internally-driven illusions, instead of freshly and creatively identifying potentially winning, energy-related value propositions.

After the financial crisis, the eventual exit from the financial businesses (except for financing specifically to support the sale of GE industrial products) was already very likely. With two-thirds of the remaining company being energy-related, strategy for this sector clearly should have been high priority. However, in its industrial businesses, including energy, GE had long been essentially internally-driven––prone to pursue what it was comfortable doing. (Admittedly, the IIoT venture was an aberration, where GE was not comfortable––for good reason––developing new software, big data analytics, or AI.) Otherwise, however, in the energy related businesses, GE would stay close to what it saw as core competencies, rather than rethinking and deeply exploring what these markets would likely most value in the foreseeable future.

In these markets, GE focused on fuels based on immediate-customers’ preferences, and where GE saw competitive advantage. Although GE developed a wind power business, it largely stayed loyal to fossil fuels. A 2014 interview in Fast Company explains why:

Immelt’s defining achievement at GE looked to be his efforts to move the company in a greener direction [i.e., its PR-marketing campaign, “Ecomagination”].… But GE can only take green so far; this organization fundamentally exists to build or improve the infrastructure for the modern world, whether it runs on fossil fuels or not. Thus, GE has simultaneouslyenjoyed a booming business in equipment for oil and gas fracking and has profited from the strong demand in diesel locomotives thanks to customers needing to haul coal around the country.… In the end, though, it will serve its customers, wherever they do business.

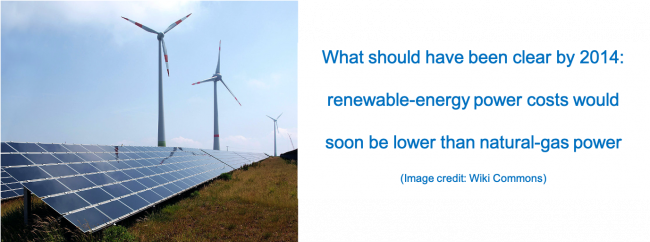

Serving immediate customers can be a good practice. However, it can become counter-productively customer-compelled––if a business ignores unmistakable trends in technology costs, and the preferences of many end-users. With a seemingly safe, internally driven view, GE (in 2014) lost a myopic bet on fossil fuels, acquiring the gas-turbine operations of French company Alstom. GE badly underestimated the rise of renewable energy, resulting in a $23 billion write-down.

As Part Four will review in some detail, this loss on gas turbines capped GE’s more fundamental, long-term failure, starting in about 2000, to realize its great historic opportunity––creatively leading and capitalizing on the global transition to zero-emission energy, especially renewables. The value proposition that most energy end-users worldwide wanted was increasingly clear after 2000––energy with no tradeoffs in reliable, safe performance, zero (not fewer) emissions, and lower cost.

In this failure in the energy market GE no doubt saw itself as following its customer’s demands. In customer-compelled fashion, GE kept listening to its more immediate customers’ increasing hunger for fossil-fuel based energy generation. The company would have needed a much more customer-focused, science-based perspective to see, and help catalyze, the market’s direction. It needed to study end-users, not just power-generators, and project the increasingly inevitable major reductions in renewable-energy costs, to anticipate the shift away from gas and other fossil-fuels––by many years, not just a few months sooner.

Given its historical knowledge and experience, GE was uniquely well positioned to benefit long-term from the world’s likely multi-trillion-dollar investment in this value proposition by 2050. We can acknowledge that, starting in the early 2000s, GE touted its “Ecomagination” campaign, and built a good-sized wind-power business. However, taking this value proposition seriously––leading a global energy transformation––would have required that GE take a more proactively-creative strategic approach. That would have meant designing comprehensive value-delivery-systems needed to lead, accelerate, and long-term profitably capitalize on that global energy transition.

Fundamentally important, those new value-delivery-systems would have needed to include an aggressive return to the central focus on major product-innovation that built the company in its first century. Many people, in the first decade after 2000, including most energy experts, were highly skeptical that a global transition to zero-emission energy was possible in less than most of the current century. Yet, the basic technology needed for the energy transition in electricity and ground-transportation––a crucial bulk of green-house emissions––had been identified by 2000. Renewable energy, especially solar and wind, bolstered by battery for storage––were already identified. As has largely been confirmed in the last twenty years, that technology––not major new, unimagined breakthroughs––only needed to be massively refined and driven down the experienced-based cost curves.

As will be discussed in Part Four, key parts of solar energy technologies not only dropped in cost faster than anyone expected, but also became unprofitable commodities. As GE and many others learned in the early 2000s, producing solar panels in competition with the Chinese makers became a mostly losing business. However, there are many other elements of renewable energy––wind, storage (e.g., batteries), long-distance transmission, etc. Some of these will inevitably be profitable, even if cranking out commodity solar panels is never among them. The increasingly clear reality since 2000 has been that renewable energy will dominate the global market, and GE should have been playing a leading role.

Other technology, perhaps including hydrogen and some as-yet developed battery technologies, will be needed for some industrial and other sources of emissions not likely replaceable by solar or wind. However, for electricity and ground transport, today we know that these now-proven renewable-energy technologies are lower cost than the fossil-fuel incumbents. In the wide range of product innovations needed to enable this part of the energy transition, GE could and should have been leading the world these past twenty years, rather than just issuing PR lip-service with meagre substance.

Such actions to lead the energy transition, discussed in Part Four, would have included aggressive, imaginative value-delivery-systems by GE, involving not just power generation, but also long-distance transmission, electrification of energy uses (e.g., heating, cooling, transportation, industrial processes), storage––especially battery––technology, and energy-focused financing. Sharing a zero-emissions value proposition could have created great synergy across these GE product-innovations and related businesses. GE could have also used its once-great credibility, to influence public policy, including support for economically rational zero-emission technologies. This excludes asking end-users to accept higher costs or other tradeoffs to save the planet. GE could have proactively, creatively generated great corporate wealth if policy had evolved to allow zero-emission solutions to deliver their potentially superior value.

More strategically fundamental than GE’s inept lost bet after 2013 on natural gas turbines, GE’s historic lost opportunity in its core energy markets was this enormous and inevitable transition to zero-emissions. The same customer-focused, science-based, synergistic strategy, including major product-innovation, that characterized GE’s first century––could have and should have been central to the company since 2000.

Eventual impact of GE’s last four decades––on GE and the world

After 1981, GE achieved a twenty-year meteoric rise behind the Welch strategy, but fundamentally failed to extend the creative, persistent focus on superior value-delivery via product innovation that drove the company in its first century. The cumulative effect of the company’s strategic illusions and inadequate value-delivery was that GE eventually lost control of its destiny, along with most of its market-value and importance. Even after the company’s recent strengthening, its market value is still only about 20% of its 2000 peak after the Welch era, and less than 50% of its 2016 value––its post-financial-crisis peak.

The world also incurred losses, including regrettable influences on business. Rushing to emulate GE, many embraced Six Sigma’s focus on continuous marginal improvement, and an idolatry of maximizing shareholder value. For GE and shareholders, these practices yielded some benefits. However, they also coincided with reduced value delivery, including a sharp decline in major product-innovation. We can see some results of this influence in the world’s lagging innovation and productivity, notwithstanding the often-overrated inventions of the finance and tech sectors. Also lost for the world was the value that GE might have delivered, had it seriously acted on its key opportunity in energy. These losses were the tragedy in GE’s lost control of its destiny, in the four decades after 1981.

Accordingly, after this Introductory Overview, the series continues with four parts:

Part One: Customer-Focused, Science-Based Product Innovation (1878-1980)

Part Two: Unsustainable Triumph of the Welch Strategy (1981-2010)

Part Three: Digital Delusions (2011-2018); and

Part Four: Energy Misfire (2001-2019)

To continue reading this Series on GE, go to Part One.

Footnotes––GE Series Introductory Overview: [1] though of course not using our present-day, value-delivery terminology